Capital structuring

Our services

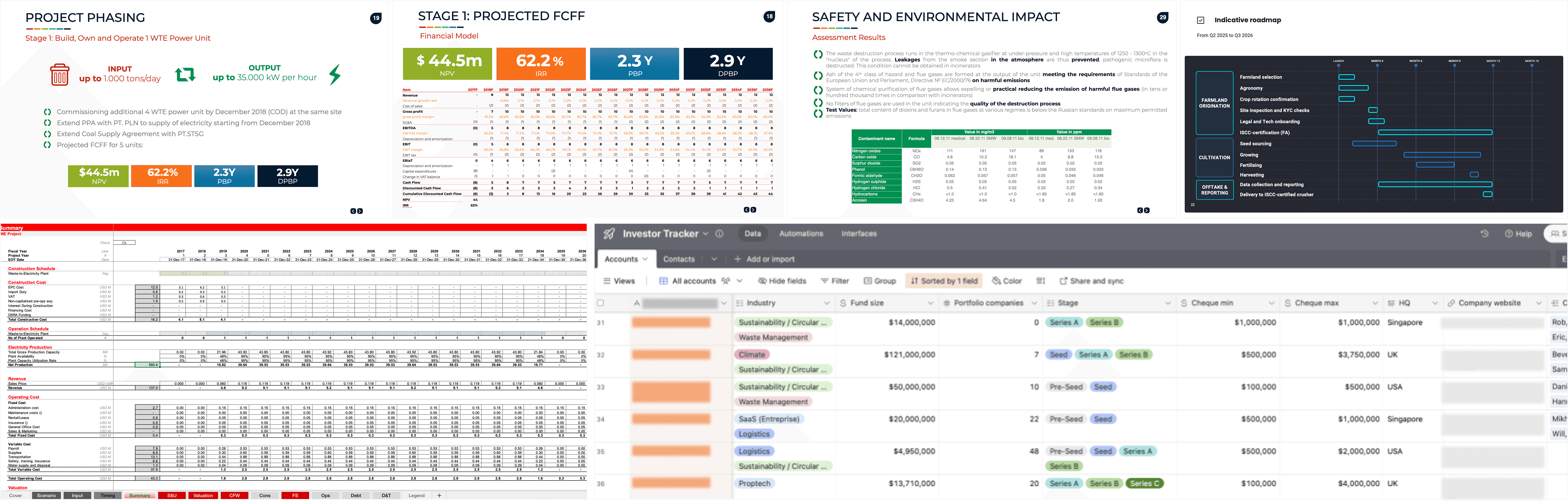

A structured launch roadmap tailored to your stage and capital needs.

01 CAPITAL STACK ARCHITECTURE

We design the optimal mix of equity, debt, grants, and guarantees. We move you away from dilutive VC capital towards cheaper project finance instruments tailored for industrial ventures.

02 COMMERCIAL BANKABILITY

Capital providers do not buy technology; they buy certainty. We help you structure Offtake Agreements and Feedstock Contracts to demonstrate the secured revenue streams that lenders require.

03 ORIGINATION & PLACEMENT

We manage the fundraising process, connecting you with the specialised capital pool beyond VC: Development Finance Institutions (DFIs), Family Offices, and Corporate Venture Capital (CVC).

04 INVESTOR MATERIALS

We prepare the institutional-grade documentation required for due diligence: the Financial Model, the Information Memorandum (IM), and the Data Room architecture.

Who is this for?

Target project profile:

GOAL:

Moving from a pilot unit to a fully operational commercial facility.

CHECK SIZE:

You are looking to raise £10M – £50M+ in CAPEX funding (Debt or Equity).

SECTOR:

Energy Transition, Circular Economy, Advanced Materials, or Industrial Infrastructure.